Pre tax income calculator

Earnings before Tax is calculated as Earnings before Tax EBIT Interest. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

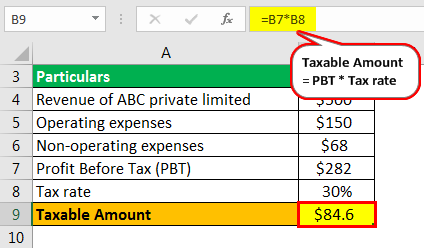

Income Tax Formula Excel University

Effective tax rate 172.

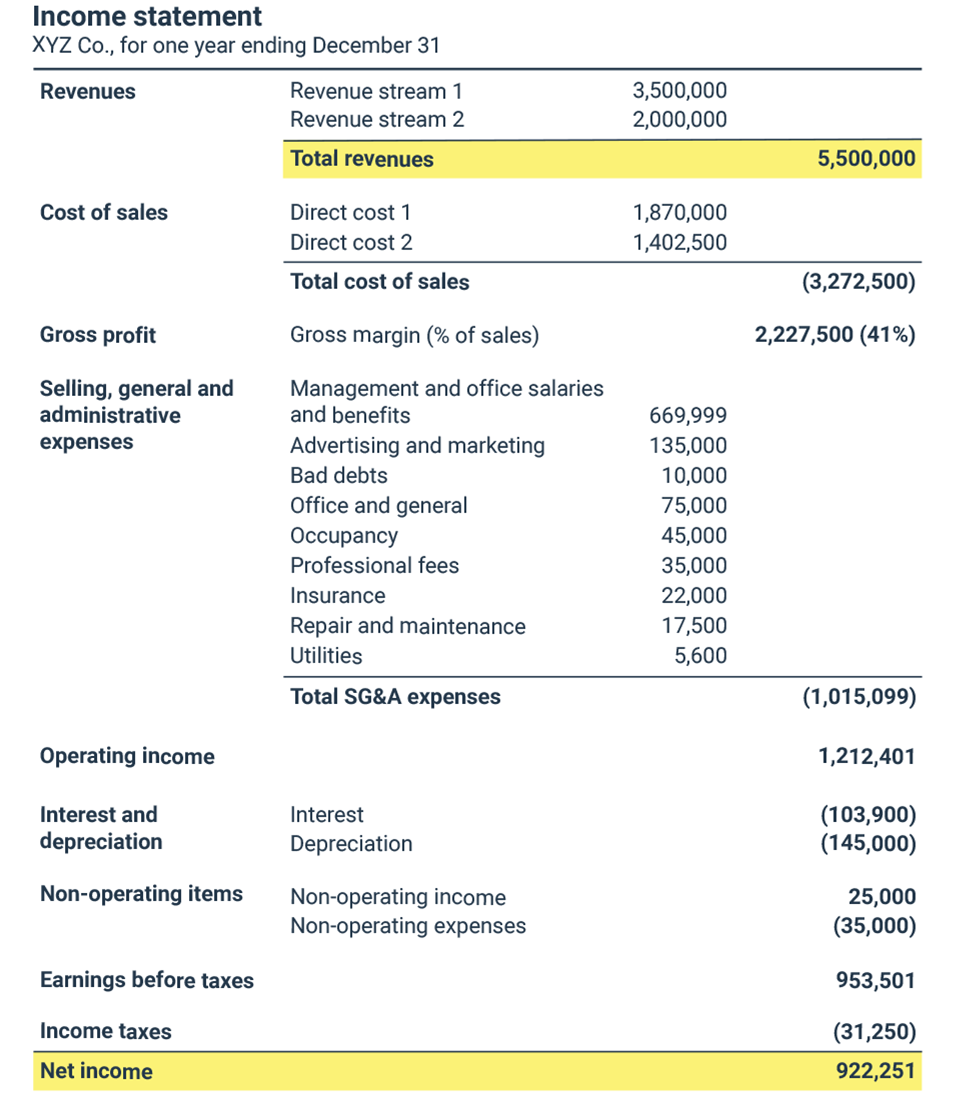

. Earnings Before Taxes EBT Net Income Taxes EBT can sometimes be found on the income statement. It can be used for the. Net Income Earnings Before Taxes 1-Effective Tax Rate With a little of arithmetic we get.

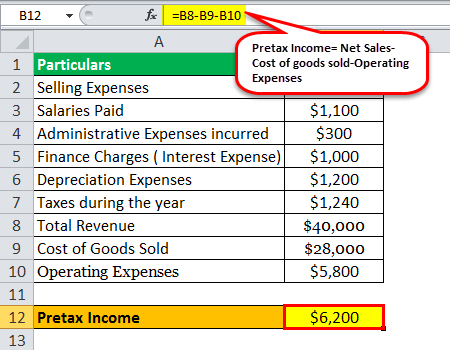

Estimate your US federal income tax for 2021 2020 2019 2018 2017 2016 2015 or 2014 using IRS formulas. You are required to calculate Earnings before tax using the information given below. Pre-tax Income Gross Revenue Operating Depreciation and Interest Expenses Interest Income What is the pre-tax profit margin.

Reverse Tax Calculator 2022-2023. This valuable tool has been updated for with latest figures and rules for working out taxes. It can also be used to help fill steps 3 and 4 of a W-4 form.

Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Using the formula above the pretax income of Company ABC is calculated as. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

This is the formula for calculating pre-tax income. Your average tax rate is. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. The amount generally needed to rent a. Add your total gross pre-tax household income from wages benefits and other sources from all household members.

Earnings Before Taxes Net Income 1-Effective Tax Rate Now back to. It uniquely allows you to specify any combination of inputs when. The ratio can be calculated using the following equation.

Enter your info to see your take home pay. Pre-Tax Savings Calculator Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0. Discover Helpful Information And Resources On Taxes From AARP.

The calculator will calculate tax on your taxable income only. Pretax Income 8000000 560000 86000 12000 240000 130000. When you make a pre-tax contribution to your.

How To Calculate Pre-Tax Income As previously stated pretax income is computed as the difference between a companys revenue and its operational expenses. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. A pay period can be weekly fortnightly or monthly.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. That means that your net pay will be 43041 per year or 3587 per month.

Pretax Income Definition Formula And Example Significance

/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

Ebit Vs Operating Income What S The Difference

How To Calculate Net Pay Step By Step Example

Annual Income Calculator

Income Tax Formula Excel University

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

How To Calculate Net Income Formula And Examples Bench Accounting

How To Calculate Gross Income Per Month

How To Calculate Tax On Salary Deals 53 Off Www Prestigepaysage Com

Ebit Formula And Operating Income Calculator

Net Profit Margin Calculator Bdc Ca

Net Profit Margin Calculator Bdc Ca

What Are Marriage Penalties And Bonuses Tax Policy Center

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Formula Excel University

What Are Earnings After Tax Bdc Ca